The following statement: "it is more expensive to sell less," when referring to a structured settlement factoring transaction is true when speaking in structured settlement factoring language. The pricing structure of the factoring market uses discount rates as a scale to determine the cost to the annuitant or tort victim. There are several reasons that it may appear to be more expensive to sell less of your structured settlement.

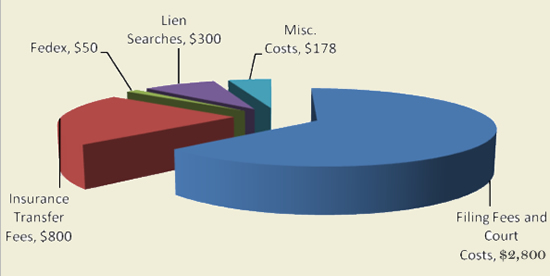

Every structured settlement factoring transaction has standard costs associated with it. Below is a pie chart outlining these costs:

- Filing fees and court costs range from $2300- $2800 depending on the state

- Insurance transfer costs range from $500- $800 depending on insurance company and double if the payments are split

- Miscellaneous fees usually range from $150- $175

- Lien search costs are $300 (to make sure that the annuitant does not owe taxes, child support etc.)

- Fedex costs $50

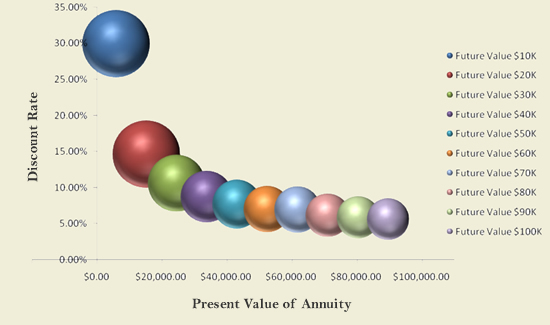

These standard costs are present on every structured settlement factoring transaction whether the tort victim is selling a present day value annuity of $10K or whether they are selling an annuity with a present day value of $100K. The discount rates of the annuity are effected by the amount of costs to complete the transaction. The graph below illustrates the scenario.

As you can see the larger the present day value of the annuity, the lower the discount rate of the transaction equates to.

This scenario is an example of how the discount rates are effected by the standard costs of a factoring transaction. Settlement Quotes does NOT suggest to sell more structured settlement payments to reduce the discount rate of the transaction.

This blog post is to help tort victims and other financial professionals understand the relationship between the present day value of an annuity and the discount rates of a transaction. If you have any questions or concerns, please comment below and if you would like to learn more about structured settlement factoring click here.